Banking & Financial

Banking & Financial Services

- Secure, Smart, and Seamless - Future-proof your financial systems with tailored solutions.

- Unlock financial freedom with secure, convenient, and customizable solutions.

- Where security meets convenience in financial services.

- Stay ahead of the curve with next-gen banking and financial solutions.

- Redefining financial security by empowering businesses with secure, fast, and tailored solutions.

Your financial services with cutting-edge solutions.

Make your banking process flawless with our banking solutions, tailored to your needs.

Secure, smart, and seamless!

Next-Gen Banking and Financing: Simplifying and Enhancing Security

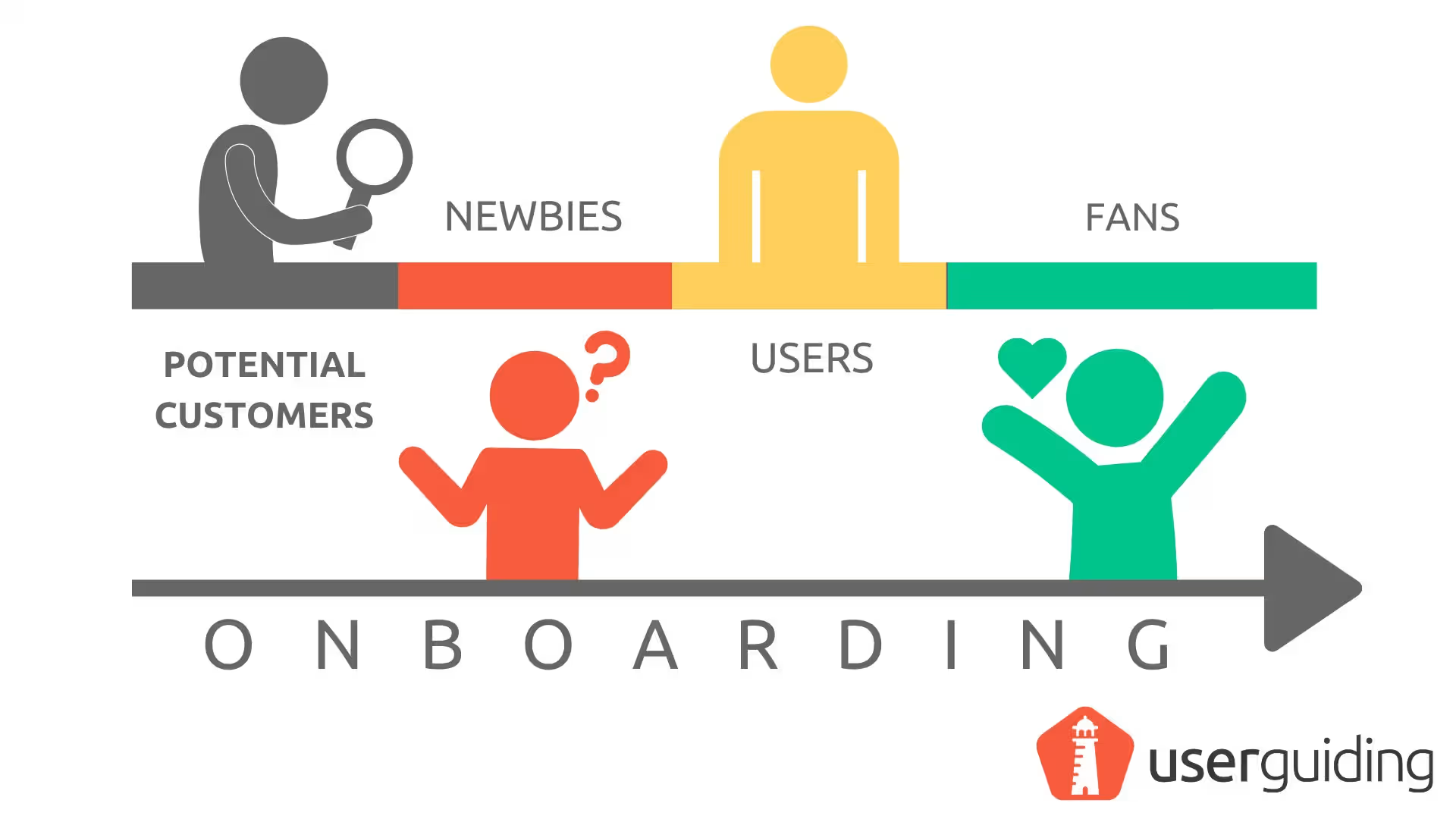

Intelygic’s Banking & Financial Services cater to the evolving needs of modern financial institutions, focusing on seamless customer onboarding, biometric Know Your Customer (KYC) solutions, and anti-money laundering (AML) compliance. Our customer onboarding software simplifies account setup and user verification, creating a smoother experience for new clients.

With biometric KYC, banks can offer a secure and quick identity verification process, boosting trust and reducing fraud risk. Our AML compliance solutions ensure that financial institutions meet regulatory standards efficiently. Additionally, our tailored banking app development provides secure and user-friendly digital banking solutions for a complete and robust customer experience.

Why Choose Intelygic

- Fast and secure

- Automated verification processes

- Enhanced customer satisfaction

- Higher trust levels

- Seamless regulatory compliance

- Convenient and user-friendly

What We Offer For Banking & Financial Institutions

Customer Onboarding Software

Our customer onboarding software streamlines the entire account setup process, making it faster and more efficient. With automated workflows and intuitive interfaces, clients can verify their identities and start using services quickly, boosting customer satisfaction from the start.

Biometric KYC

Our biometric Know Your Client solution provides advanced security for verifying customer identities using biometric data, such as fingerprints or facial recognition. This not only enhances security but also reduces onboarding times and adds a layer of trust by minimizing fraud risk.

Faster verification, safer transactions – Because your clients’ trust matters.

AML Compliance Solutions

We offer robust Anti-Money Laundering compliance tools in our banking & financial services that help institutions meet regulatory requirements seamlessly. By automating risk assessments and flagging suspicious activities, our solutions support regulatory compliance and help mitigate financial crimes.

Banking App Development

We offer secure, user-friendly banking app development services tailored to meet the needs of modern users. Our apps offer seamless digital experiences for clients, allowing them to manage their accounts, perform transactions, and access financial services conveniently from any device.

Biometric KYC

Our biometric Know Your Client solution provides advanced security for verifying customer identities using biometric data, such as fingerprints or facial recognition. This not only enhances security but also reduces onboarding times and adds a layer of trust by minimizing fraud risk.

Faster verification, safer transactions – Because your clients’ trust matters.

Want To Make Your Banking More Secure?

Why Go For Our Banking & Financial Services

Streamlined Customer Onboarding Experience

With our efficient digital banking onboarding solutions, financial institutions can speed up the account setup process. This results in a smoother, hassle-free experience for customers, improving first impressions and increasing customer satisfaction from day one.

First impressions simplified!

Advanced Security with Biometric KYC

Our digital KYC solution for banking provides high-level security through cutting-edge biometrics, like facial and fingerprint recognition. This extra layer of protection reduces fraud risk while ensuring faster and more reliable identity verification.

Because trust begins with secure identities

Robust AML Compliance for Risk Mitigation

Stay compliant with our anti-money laundering solutions designed to keep up with changing regulations. We help financial institutions prevent financial crimes with automated compliance tools, safeguarding your business from regulatory and reputational risks.

Compliance without compromise – Safeguard your business reputation

Customized Banking App Development

Our custom banking app development services in the USA offer a secure and user-friendly digital banking experience. Designed with the latest technology, they allow clients to handle transactions, monitor accounts, and access financial services, providing convenience and accessibility on any device.

Build secure digital experiences your customers will love

Save Yourself From Risks And Lawsuits with Our Offerings

Why Our Services Are Not Just Limited To The Bank

Our banking and financial services are ideal for a wide range of financial organizations beyond traditional banks.

Beyond just banks: tailored solutions for all financial players

These services cater to fintech companies, credit unions, insurance firms, investment and asset management firms, and lending institutions.

Whether it’s banking or beyond – we deliver success

By integrating solutions like customer onboarding software, biometric KYC, AML compliance, and custom banking apps, we help these organizations improve security, streamline processes, and stay compliant with regulatory standards, ultimately enhancing customer satisfaction and trust.

Industries Using Our Banking & Financial Services

- Traditional and digital banks

Enhanced security, fast onboarding, compliance with banking regulations. - Fintech companies

Streamlined user experience, advanced fraud detection, and personalized services. - Credit unions

Secure mobile apps, automated compliance, and faster customer onboarding. - Investment firms

Risk mitigation, secure transactions, and regulatory compliance. - Lending institutions

Secure loan processing, fraud detection, and identity verification.

Frequently Asked Questions

Biometric KYC solutions enhance security by using unique biometric data like fingerprints or facial recognition, making customer verification faster and more secure while reducing fraud risks.

Our AML compliance solutions in the USA monitor transactions in real-time, flagging suspicious activity to prevent money laundering and ensure compliance with regulatory standards.

Yes, our digital banking onboarding solutions is designed to integrate seamlessly with various banking systems, allowing for efficient, automated processes without disrupting existing workflows.

Our Banking App for New Account Opening includes features such as secure login, real-time account monitoring, fund transfers, bill payments, customer support, and personalized financial insights.

Absolutely. Our digital KYC solution for banking adheres to global data privacy laws like GDPR, ensuring customer data is collected, stored, and processed securely.

Our AML solution is built to be flexible, allowing regular updates to stay aligned with evolving global and local compliance requirements, reducing the risk of non-compliance.

We incorporate multi-layered security protocols, such as data encryption, two-factor authentication, and real-time fraud detection, to safeguard users and maintain the integrity of financial data.